How to Play the Banks at Their Own Game (and Get Solar Approved)

So, you’ve got your solar quote in hand, a power bill that screams “help me,” and the ambition to tell the power companies to take a hike. But there’s just one problem — you need the bank to say yes.

Fear not, solar-seeker. Here’s how to make the numbers stack up in your favour, and maybe even outsmart the bank in the process.

The Big Three: ANZ, ASB, BNZ — 1% Interest for 3 Years

Let’s start with the best-kept not-so-secret: these banks offer 1% interest on “green loans” for solar, locked in for 3 years. Sounds great, right?

But here’s what most people don’t realise:

You can structure the loan over any term — 5, 10, even 15 years. Only the rate is fixed at 1% for 3 years.

That’s your golden opportunity.

Stretch It Out to Bring It Down

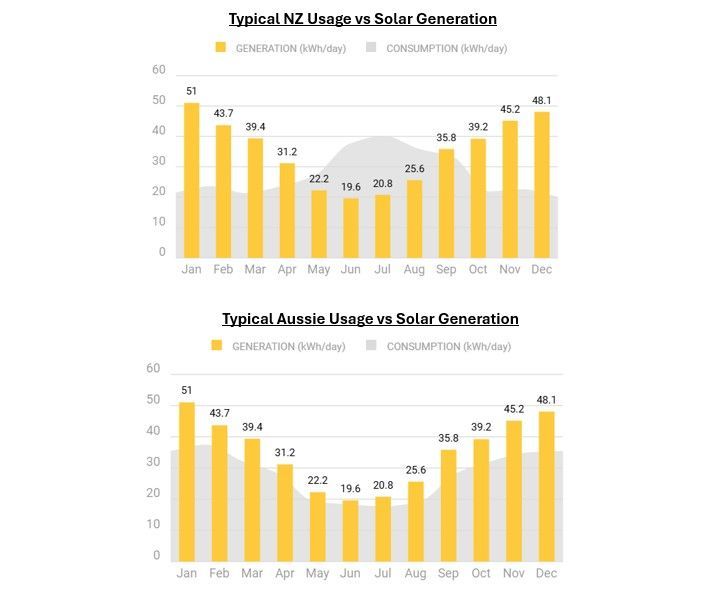

Most solar systems in NZ pay themselves off in 8 to 10 years, depending on where you live and how sunny your roof is. That means, even on a 10-year loan, your solar savings will typically outpace your repayments — especially with that 1% head start.

Why go long?

Because the bank's magic word is

"affordability."

The longer the loan term, the lower your repayments, and the more likely the bank’s little robot goes, “Approved ✅.”

Tight budget? Go long. Want to pay it off fast? Here's the hack:

The Offset Hack: Bash It Down After 3 Years

During those first 3 years, make the minimum payments and put your extra cash into a savings account (earning more than 1%, if you’re clever). Then, when the 3 years are up and the rate resets to 5%-ish, you slap down a chunk of your savings and boom — your remaining repayments shrink to pocket change.

It’s like doing HIIT training for your mortgage: fast, smart, and weirdly satisfying.

And What About Westpac?

Westpac offers 0% for 5 years — and it’s a flat term loan, no stretch, no trickery.

It’s a solid deal, especially if you’ve already got equity and want to keep it simple.

But if you’re juggling affordability with long-term strategy, the other banks give you more levers to pull.

Bottom Line

If your quote’s good and your roof’s sunny, solar almost always pays for itself — but only if you can get it across the bank's desk. The smartest borrowers are using loan terms strategically to get approval, reduce their repayments, and make solar a true no-brainer.

Want help making the case to your bank?

Send us your solar quote, and we’ll crunch the numbers to show you how it stacks up over 10 years — savings, repayments, the works.

Because around here, we don’t just talk about solar.

We game the system — for you.