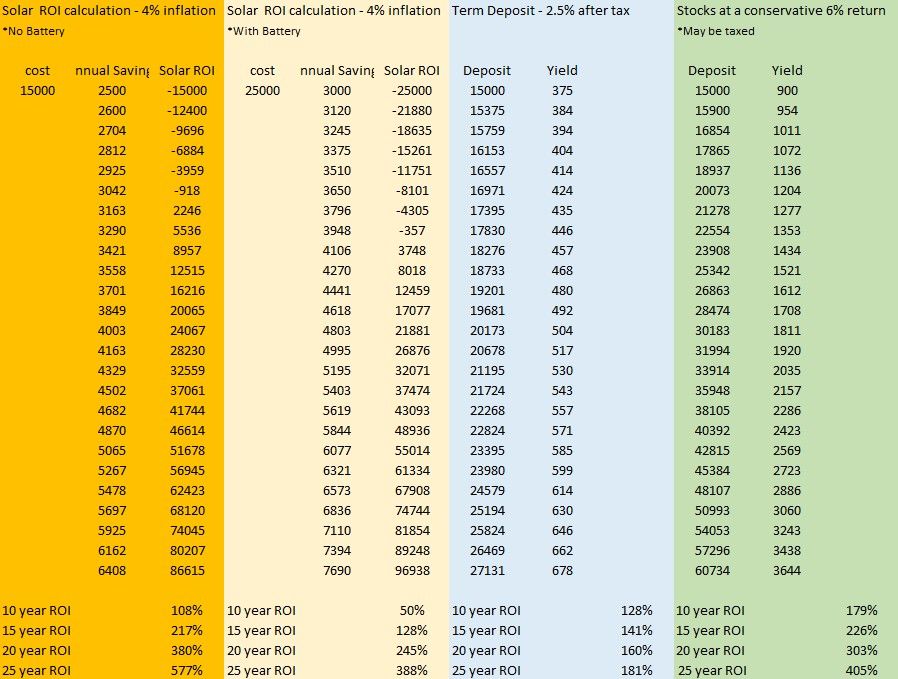

How does solar stack up against other commercial investments?

What if I told you produces returns better than the average NZ business? 😎

But unfortunately ... 🤐

Us solar guys have a tough gig, as NZ Business owners often tell us "We can make more money investing in... XYZ... instead of going Solar."

Respectfully, I beg to differ.

The attached photo is from stats.govt.nz, which demonstrates that the average Return On Assets for NZ business sits below 5%.

ROA tells the story of how businesses are generating returns for their shareholders.

How is it so low???!!!!

... Most projects, globally, and in every business, fail to deliver the forecasted net benefit.

More on ROA.

Shareholders obtain partial ownership of businesses that should grow their wealth.

Businesses put assets (or capital) to work, to generate profits for shareholders.

Higher ROA generally means better returns for shareholders.

*Few businesses pay dividends, but instead, reinvest their profits.

*Reinvested profits grow assets and therefore, owners' equity (if invested wisely).

So how does business management make calls on where to invest?

Capital allocation... That's the term.

Forecasting return on assets is a common method employed to measure the viability of a new project, product line, marketing initiative, or other investment.

IE; new machinery is an asset. So is a new warehouse.

Do we spend 1 mil on plant, property and/or equipment, to grow our business?

Well... What could it return?

2mil in revenue from increased sales!

Subtract input costs... Wages... Overheads... Marketing (to sell the new product)... Logistics... and TAX!!

2mil quickly becomes $100k in net profit. An ROA of 5%.

How does Solar compare?

Easy 🙌

Most systems generate an ROA upwards of 10%.

The savings/returns are non-tangible, or, NON-TAXABLE.

Overheads? Practically none.

Wages? ... Zilch.

Sales and marketing people required? ... Nada.

Dependent on a growing economy? Not at all.

So, what's the catch?

You're relying on the sun.

And that's infinitely better than relying on:

Supply chains

Economic demand

Staff/people retention

Luck (most projects underdeliver according to forecast)

Solar is a sound capital allocation decision.

It can be even better if you don't use your own money. (Talk to me about PPA's, OPEX solutions).

Solar delivers consistent, as expected returns, with little to no risk of upside or downside.

These returns will strengthen your bottom line, consistently growing owners equity

and shareholder returns.

If you're interested in saving time, and money, connect with us on our contact page to get started.